The Profits of Trading Are in Dopamine, Not Dollars

Superstition is Learned

Skinner’s pigeon experiment (video) shows how superstition can be created, at least in pigeons. By feeding pigeons infrequently and randomly they are randomly conditioned. These hungry birds can’t know what makes the food appear, but they make connections anyway. They dance and poke and duck, desperately trying to summon the food. The rarity of the payout actually makes the behaviour stronger, a fact useful in dog training.

I met with a vision of desperation in a dingy casino on a weekday afternoon. Between a few groups of people having a good time I saw roving solo gamblers studying tables to feel for edge. These desperate professionals were not there to play; they needed money. Unfortunately for them, casinos pay out at random and condition superstitious thinking. The mood at the bus stop leaving was tragic.

Skinner made superstitious pigeons, and I think markets make superstitious gamblers. You can be a net loser in the market and feel great about it; especially if you’ve learned how to manage how bad your losses feel by cutting them early.

The Expectation of Profit is Negative

This is a cliche point today. I’ll just present these statistics from Interactive Brokers: between 43% and 47% of the forex accounts registered with them are profitable. People in aggregate are not good at this in the long run. This is an important fact when considering our own abilities. The prior probability sucks: we have to disbelieve our success.

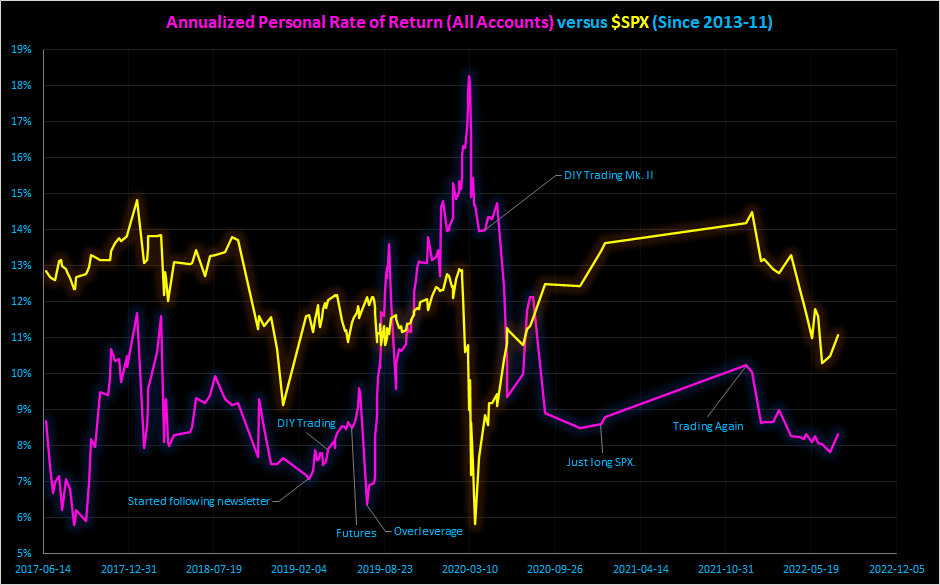

This broad statistic is an average over all accounts; if you looked at individual trader profit and loss over time you’d find it to be volatile. I don’t have access to other people’s data, but here’s mine:

If I was writing this in March 2020 some might think I was really on to something and ask to follow my trades. They’d follow me in losing my profits, except without the benefit of having gained them in the first place. I was overconfident and I went against my process, but I was sure I knew how to make it rain.

When we see successful traders we are seeing a snapshot in time. Tomorrow may ruin them. In the long run the most probable outcome is mediocrity. It doesn’t mean good traders don’t exist, but we should be skeptical of them and especially of ourselves. We aren’t so different from pigeons.

“Functional” Gambling

You can observe these same desperate souls by visiting Twitter or Trading View. You’ll find auspicious moving averages, the 0.618 Fibonacci retracement, an overbought RSI, a divergent MACD, whatever it takes to get them in a sexy trade. These traders all have feigned confidence in common, sharing their observations without evidence that supports the value of their signals.

Evidence isn’t what made them select those indicators. They poke around charts with a deep toolbox until they find themselves attached to particular set. I think Skinner explained how they land on those tools. If you get a big payout when using a MACD divergence as a trade signal you’re probably going to think that’s valuable; nevermind that a properly done backtest or statistical test would refute it.

I think robust performance metrics are not standard because:

- They require accurate records of flows, and that’s boring

- They would show that the trader using them is bad at trading

Who’s going to use the same metrics as someone who sucks? If you visit a forex trading forum you’ll find folks using backtested sharpe ratios, “profit factors” and other metrics to determine the profitability of their trading. Few would compare any of these to buying-and-holding in the S&P 500, nevermind that almost all backtests are fatally wrong. They don’t know it, but their goal isn’t to beat the market; it’s to ride that gambler’s high.

They remember their hits and forget their margin calls. They let their winners run, and cut their losers early. This belies a strategy for managing addiction, not profit. These strategies keep the rush of their gambling going. They probably don’t know exactly what they are doing; they are just following incentives.

The worst thing to happen to a new trader is for them to win big. It takes failure or heroic strength of will and self-preception to avoid succuming to most addictions. Folks with other problems in their lives are especially succeptable. If you feel bad and something makes you feel great sometimes, you’ll probably be drawn to it.

The COVID-19 pandemic lockdown saw an explosion in retail trading, but it also saw a huge increase in anxiety and depression. I think these things are linked and that people are self-medicating with gambling.

Self-Honesty Through Numbers

Measuring how much money you make with trading is not something that requires industry specific knowledge. You look at the money you started with, consider inflows and outflows (inc. commission, data fees, etc.) and calculate something like an internal rate of return (IRR)1. Dividing your profit by your max drawdown or your profit by your losses obfuscates your performance and makes it challenging to compare with a benchmark. I agree volatility matters, but don’t try shoving that into the same metric; it’s a separate one.

The IRR is analogous to how savings account interest works. If my IRR is 7%, that means my account performs identically to a savings account that earns 7% interest. Want to compare against a benchmark? Compute the IRR of the benchmark for the same period and subtract; make sure you use dividend-adjusted numbers. These are performance metrics your grandmother can understand.

Yeah, you have to do extra math to get this number. You have to track your flows. Boo-hoo, this is not a game. This isn’t even enough! You should also have a good understanding for why you’re in a trade with statistical and scientific evidence as best as you can manage. That latter point has been the primary focus of my writing in the past under the “confirm signal” moniker.

Process Matters

Traders rarely have doubt as a pillar in their process. I track my performance closely to counteract the thrill of winning and keep an objective perspective. I also only trade on things that I have a rational basis for; not just a narrative basis, but a causal and statistical basis. It is incredible difficult to avoid fooling yourself when trading; the thrill of making thousands in moments is overwhelmingly seductive. We are playing with fat-tailed distributions with sample sizes measured in the dozens, profit and loss is still not enough to know if you’re right.

Process is the only tool we have to remain objective. Unfortunately for new traders most process they find will be written by functional addicts. Trading is psychologically dangerous. Overconfidence in this area of your life will spill beyond it, and your profit and loss in the real world is harder to obscure.

Manage your lizard brain, or it will manage you.

Footnotes

-

This is available in Excel using the XIRR function. ↩︎